Canara Bank,a leading Public Sector Bank, has been a pioneer in the banking industry for offering state of the art tech-aided banking services and products matching the market dynamics. It has always been Bank’s endeavor to be a one-stop shop for entire banking and financial needs of the customer.

Reflecting that the Bank is all geared up for organic growth with enhanced focus on domestic business, Bank declared a net profit of Rs 300 Crores for Q2FY 2018-2019, with a robust growth of 15.38% y.o.y, backed by a healthy pace of net interest income (NII) growth at 17.89% y.o.y. The solid performance in NII growth is driven by 18% y.o.y growth in domestic advances supported by stellar growth in retail credit at 35% y.o.y.

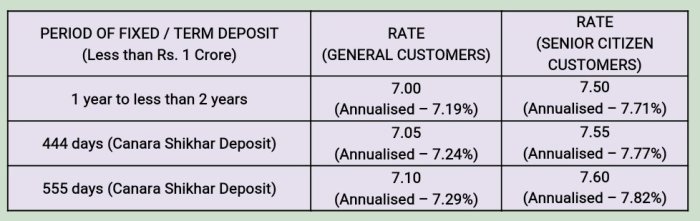

Coinciding with the ebullient financial results for Q2,Bank also announced a treat for its retail customers with increase in rate of interest on fixed deposits for 1 year by 20 bps wef 01/11/2018, for deposits less than Rs. 1 Crore, taking the interest rate to 7% (for general customers) and 7.50% (for senior citizens).The annual yield works out to be 7.19% and 7.71% respectively. With this increase, the interest on fixed deposits for 1 year to less than 2 years period will be 7% (for general customers) and 7.50% (for senior citizens).

Canara Bank has special fixed deposit schemes for 444 and 555 Days where the rates are as high as 7.05% &7.10%(for general customers) and 7.55% &7.60% (for senior citizens).The annual yield works out to be 7.24% &7.29% for general customers and 7.77% &7.82% for senior citizens.The interest rates being offered now are most competitive amongst the PSB banks with much better and attractive yields.

City Today News

(Tj vision media)

9341997936