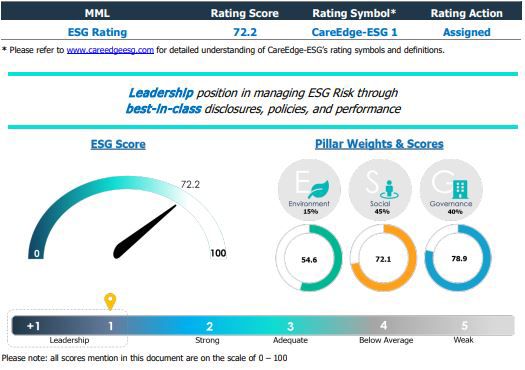

Bengaluru, May 6, 2025 — Muthoot Microfin Limited has achieved a major milestone in sustainable finance by securing an impressive ESG (Environmental, Social, and Governance) score of 72.2, earning the CareEdge-ESG 1 rating—the highest possible tier from CARE ESG Ratings Limited, a SEBI-licensed ESG rating agency.

This score not only places Muthoot Microfin among the top ESG performers in India’s financial services sector but also marks the highest-ever ESG rating awarded by CARE in the microfinance industry.

Outperforming Industry Benchmarks Across ESG Pillars

Muthoot Microfin has outshone industry medians across all ESG parameters:

Governance Score: 78.9 (Industry Median: 64.5)

Powered by a diverse and independent board, ISO 27000-certified data security, and robust policies on ethics, anti-bribery, and whistleblowing.

Social Score: 72.1 (Industry Median: 56.5)

Featuring a 100% women borrower base, a 95% grievance resolution rate, gender pay parity, and six consecutive Great Place to Work certifications.

Environmental Score: 54.6 (Top Quartile)

Rooftop solar installations across 50 branches, INR 27.5 crore in green loans disbursed, and a net zero emissions target set for 2040.

The company has also maintained a strong ESG risk register and climate risk framework, in line with global best practices.

Driving Inclusive Growth

Muthoot Microfin’s commitment to gender equity is reflected in initiatives like “Pink Hiring” and the “HER Initiative”, supporting women in the workforce through tailored programs, EV acquisition assistance, and subsidised housing—strategies that have significantly improved retention and workforce resilience.

The company has demonstrated exemplary data governance with zero data breaches in FY24, full compliance with the Digital Personal Data Protection Act, and stringent access control protocols.

Leadership Commentary

“At Muthoot Microfin, ESG isn’t an afterthought—it is the foundation of how we deliver impact at scale,” said Sadaf Sayeed, CEO, Muthoot Microfin Limited. “This top-tier ESG rating reflects our dedication to empowering communities, building resilience, and ensuring that our growth uplifts lives meaningfully.”

Setting a Standard for ESG-Conscious Stakeholders

The CareEdge ESG rating draws from over 1,500 data points spanning governance, social responsibility, and climate risk. With an overall score of 72.2, far above the sector median of 56.8, Muthoot Microfin is now positioned as a trusted partner for ESG-aligned investors and stakeholders, underlining its strategic leadership in ethical and inclusive finance.

City Today News 9341997936