Bengaluru, June 16 — In a bid to tap into India’s growing base of high-net-worth individuals and first-generation entrepreneurs, Shriram Wealth — a newly formed joint venture between the Shriram Group and South Africa’s Sanlam Group — has launched its operations in Bengaluru.

The 50:50 partnership aims to bring global expertise in wealth management to Indian investors, with a strong focus on accessibility and personalized service. The company is targeting ₹50,000 crore in assets under advice (AUA) and plans to build a team of 500 wealth professionals over the next five years.

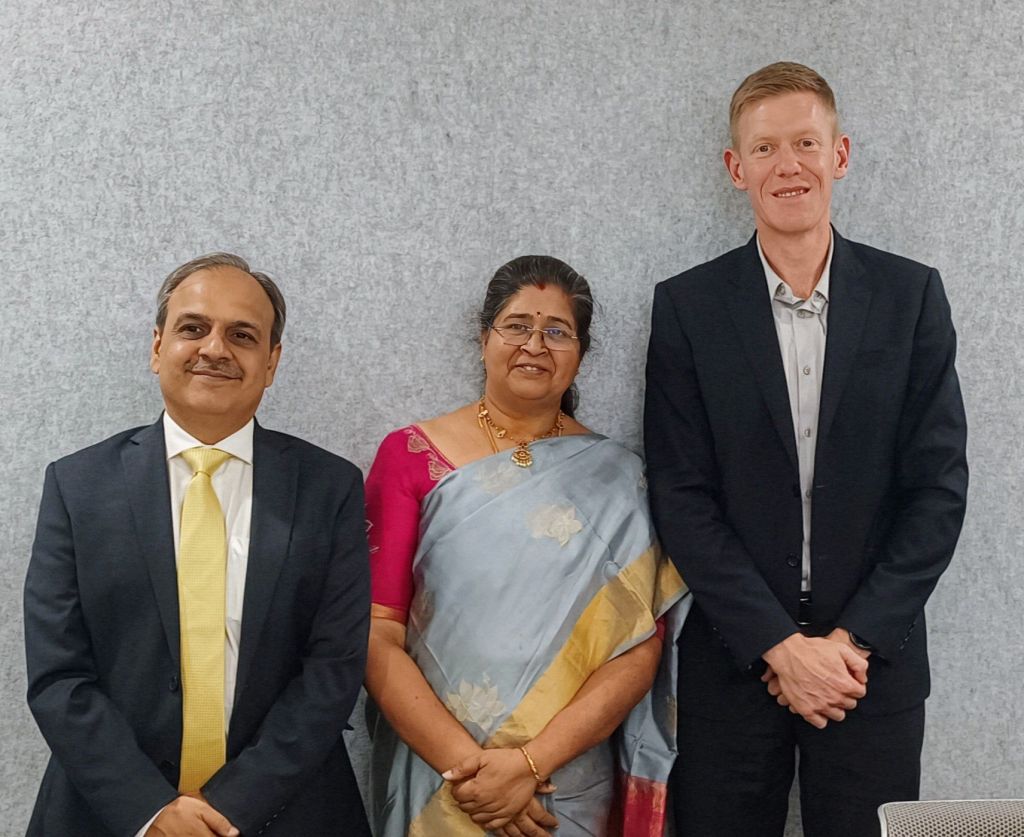

Bengaluru, known for its startup ecosystem and emerging class of affluent professionals, has been identified as a key market for the venture. The firm’s leadership said the city’s dynamic financial landscape made it an ideal location for launching its next phase of growth. “Our goal is to become a trusted partner in wealth creation by combining human expertise with digital tools,” said Vikas Satija, Managing Director & CEO of Shriram Wealth. “With Sanlam’s global investment capabilities and Shriram’s deep understanding of Indian markets, we’re confident in our ability to deliver enduring value.”

Shriram Wealth will offer a broad suite of services including investment advisory, lending solutions, insurance, global market access, and legacy planning. The firm is positioning itself as a tech-enabled, relationship-driven wealth platform catering to affluent individuals and families.

The company is also aiming to deepen its presence in Karnataka, with Bengaluru serving as the regional hub. According to Subhasri Sriram, MD & CEO of Shriram Capital, the venture represents a strategic evolution for the group.“This partnership is not just about managing wealth — it’s about enabling financial prosperity for a wider population. It marks a significant milestone in the Shriram Group’s growth journey,” she said.

The launch is aligned with India’s long-term economic ambitions. With the country projected to become a $35 trillion economy by 2047, and the organized wealth management sector expected to cross $10 trillion, Shriram Wealth plans to play a key role in bridging the gap between financial products and underserved markets.

The company is embedding artificial intelligence and analytics into its operations, offering tailored advisory, dynamic risk profiling, and real-time portfolio management. The digital-first strategy is expected to enhance customer engagement, particularly in India’s rapidly digitizing financial landscape.

Paul Hanratty, CEO of Sanlam Group, emphasized the long-term nature of the venture. “We’re here for the next 100 years — not just to manage money, but to deliver meaningful financial solutions as India’s economy and investor base evolve,” he said.

Shriram Wealth plans to begin operations in India’s top 10 cities and expand to 20 cities within a year, with a strong focus on Tier 2 and Tier 3 towns where the Shriram Group has a long-standing presence.

City Today News 9341997936